Never miss a story — sign up for PLANSPONSOR newsletters to keep up on the latest retirement plan benefits news.

Corporate Tax Cut? Profit Repatriation? Rising Interest Rates?

There is much debate in corporate boardrooms over the effect the current administration’s economic policies will have on corporate tax rates, possible repatriation of foreign profits and interest rates. Considering all the talk about the changing economic environment, PLANSPONSOR sat down with Russ Proctor and Marty Menin of the Retirement Solutions Division at Pacific Life to ask them whether these developments will help defined benefit (DB) pension plans.

PLANSPONSOR: If corporate tax rates are reduced significantly this year or next, how could this impact pension plan sponsors?

Russ Proctor: Under the assumption that corporate tax rates will get reduced, plan sponsors might consider accelerating the funding of their pension plans to take advantage of the larger tax deduction before the lower tax rates are fully effective. In some cases, the contribution could be made after the end of the plan year and still deducted for that year. For example, a company with a calendar year plan year may be able to make a contribution as late as September 15 of the following year and deduct it for the prior year’s tax return. If a plan sponsor intends to make a contribution to the pension plan in one of the next few years, it may make sense to do that in a year when it can take a larger tax deduction.

PS: What if the new administration gives companies a tax break on their offshore profits? Could they use those repatriated profits to make pension contributions?

Marty Menin: There are many reasons a plan sponsor may want to contribute available cash to its underfunded defined benefit plan. These include the potentially larger tax deduction we just mentioned, as well as reducing PBGC [Pension Benefit Guarantee Corporation] variable rate premiums. This year, the PBGC premium is 3.4% of the unfunded pension liability. Assuming average wages increase 3% per year, it is projected to increase to 3.9% in 2018 and 4.4% in 2019 (PBGC website. Premium rates. April 2017). If the plan sponsor can make a contribution to fully fund the plan, it can reduce the impact of those large and increasing variable rate premiums.

Some companies are considering “borrowing to fund.” If you can borrow at an interest rate that is close to the PBGC variable premium rate, why not borrow the money and increase the funded status of the plan? So, whether a company has cash available, borrows the funds, or captures the funds thanks to a foreign profit repatriation program, it should review their options to deploy that cash, and that analysis may include the possibility of fully funding the pension plan.

PS: What would a plan sponsor do then? Terminate the pension plan? If suddenly you’ve made a huge contribution to your pension plan, what’s next?

Menin: That’s the key question: Once you’ve got a fully funded pension plan, what do you do then? Unfortunately, unless you’ve already filed for a plan termination, and filed all the necessary paperwork with the PBGC and the IRS [Internal Revenue Service], you can’t immediately terminate the plan and get that liability off your balance sheet. A plan termination can take six to 18 months or longer. So, that’s why we’ve built insurance options that offer flexibility for plan sponsors. There are tools that can help them lock in their funded status while they proceed with their plan termination.

PS: How would that work? How quickly can a plan sponsor act to ensure its funded status doesn’t deteriorate after it has fully funded the plan?

Proctor: The quickest and probably easiest way to secure the plan’s funded status would be to use our Insured LDI [Liability-Driven Investing] solution. Insured LDI is a guaranteed match to the plan’s projected liability based on the Citi Pension Discount Curve. This provides an ideal asset/liability match for the plan sponsor. Thus, the funded status will remain stable as interest rates and equity markets remain volatile prior to full plan termination. In addition, Insured LDI is fully liquid, which allows the plan sponsor to withdraw the money without penalty at plan termination in order to pay lump sums or purchase annuities.

PS: What other options are available to plan sponsors to preserve their funded status?

Menin: There’s another tool that’s actually been a little bit more prominent in the United Kingdom. A buy-in annuity contract is an option for locking in costs and preserving funded status. Like Insured LDI, the buy-in will help stabilize the plan’s funded status and doesn’t require that the participants be notified of the annuity purchase, so the contract can be executed fairly quickly. The buy-in goes a step further than insured LDI by locking in all costs related to the annuity purchase including mortality, early retirement and other demographic changes. So, if a plan sponsor had just fully funded its plan and then wanted to quickly and completely lock in the annuity costs—say, interest rates had spiked at the same time—then a buy-in might provide a great solution.

PS: What other advantages does a buy-in provide for a defined benefit plan sponsor?

Proctor: The buy-in allows the plan sponsor to control when it completes the liability transfer regardless of what’s going on in the market at that time. When a plan is terminating, there is usually a 120-day window for the plan to distribute assets after receiving IRS approval. If interest rates drop and the plan is not properly hedged against interest rate movements, then the plan might have too little money to purchase the annuities needed. The buy-in contract can be put in place, and then the plan sponsor can file the termination paperwork, prepare notices to plan participants and do all of those things it needs to do when terminating the plan. Once the plan sponsor is ready to fully terminate the plan, it would simply write us a letter to request that the buy-in be converted to a buy-out and issue annuity certificates to participants. As far as we know, Pacific Life was the first insurance company to successfully convert a buy-in contract to a buy-out contract.

It’s important to mention that the plan sponsor is not required to terminate the plan or convert to a buy-out after purchasing the buy-in contract. In fact, the plan can keep the buy-in contract in place indefinitely or convert to a buy-out, whether they terminate the plan or not.

PS: So, to summarize, if the economic environment under the new administration encourages plan sponsors to fully fund their pension plans, it sounds like Pacific Life has some valuable tools for pension plan sponsors.

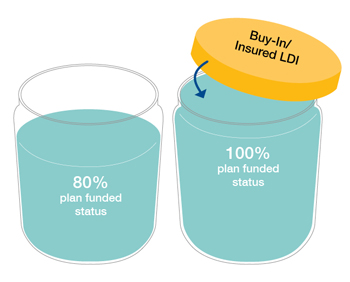

Proctor: The last thing those plan sponsors want is to fully fund their plan and then learn something’s happened in the market that has caused them to be underfunded again. Once they’re fully funded, they need to put a lid on that plan and secure that funded status. The tools we have available can help them do that.

Preserve Your Funded Status

Once a plan sponsor attains 100% funding of its pension plan, a buy-in or Insured LDI product, like that offered from Pacific Life, protects a plan’s 100% funding.

For illustrative purposes only.

Pacific Life refers to Pacific Life Insurance Company. Insurance products are issued by Pacific Life in all states except in New York. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products. Only an advisor who is also a fiduciary is required to advise if the product purchase and any subsequent action taken with regard to the product are in their client’s best interest. Pacific Life, its affiliates, its distributors, and respective representatives do not provide any employer-sponsored qualified plan administrative services or impartial advice about investments and do not act in a fiduciary capacity for any plan.