For more stories like this, sign up for the PLANSPONSOR NEWSDash daily newsletter.

Consider Near- and Long-Term Issues Before Implementing CARES Act Provisions

Plan sponsors are urged to consider factors other than the short-term financial needs of their employees before adopting new loan or distribution provisions.

More than 30 million Americans are out of work because of social distancing measures slowing the spread of the COVID-19 pandemic. One White House economic adviser recently told reporters that the unemployment rate may reach levels last seen during the Great Depression before the pandemic ends. In response, Congress and President Donald Trump passed several new laws intended to provide relief to workers, support for small businesses and other employers, and equipment and funds for hospitals and health care professionals.

The largest of these measures—the Coronavirus Aid, Relief and Economic Security (CARES) Act—not only provided $2 trillion in various types of relief, but also included several temporary retirement plan provisions providing emergency access to retirement savings for plan participants affected by the pandemic. These new options are not mandatory—each plan sponsor must decide for itself whether to adopt the new loan or distribution provisions based on its own situation and the needs of its own workforce. There are a number of factors plan sponsors should consider in addition to the short-term financial needs of their employees, including whether participants are likely to default on loans in the future, which may result in new tax penalties, and the likelihood that defaulted loans and distributions will permanently destroy hard-earned retirement savings.

What’s New with Coronavirus-Related Distributions and Loans?

The new distribution and loan provisions are separate from any existing loan or hardship provisions a plan may have. As the following chart explains, plans may decide to allow eligible participants to take a distribution of as much as $100,000, or take a new loan of up to $100,000, or both. Plan sponsors need to decide what they want to do, and then begin working with service providers, especially their recordkeepers, to decide how to implement their decisions prudently.

Participant eligibility is based on one of two factors: either the participant, spouse or a dependent is diagnosed with COVID-19, or the participant experiences adverse financial consequences due to COVID-19, which include being quarantined, furloughed, laid off or missing work due to child care responsibilities. As there has been little interpretive guidance from the IRS or the Department of Labor (DOL) as of this writing, service providers and plans must make some judgment calls about how to proceed when the statute is not clear (such as whether to allow self-certification for loan eligibility). Fortunately, recognizing the disruptive effects of the pandemic, these enforcement agencies generally have indicated that they will provide latitude for compliance efforts made in good faith.

Key Considerations for Plan Sponsors

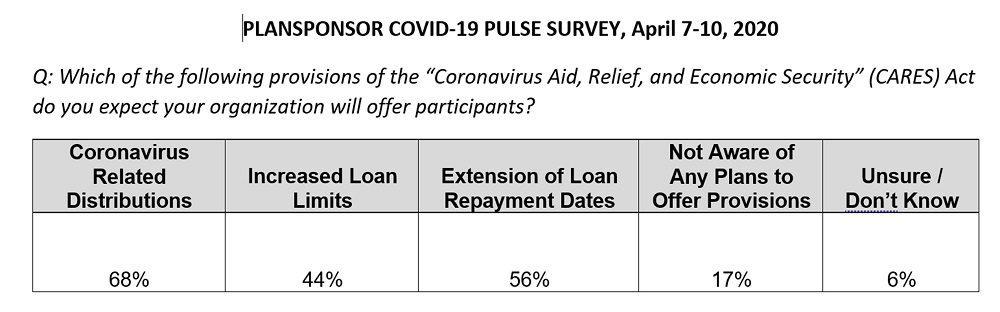

Unsurprisingly, given the rapid pace of these changes and the need for clarifying guidance on certain legal issues from IRS and DOL, plan sponsors have a wide range of opinions on the new options. As a recent survey by PLANSPONSOR indicates, plans are not uniformly adopting all of these provisions.

Balancing Emergency Liquidity with Preserving Retirement Benefits

Therefore, if adopting the new loan provisions, plan sponsors are well-advised to take loan default risks into account and consider ways to mitigate these risks. Here are some things to consider:

- What if the participant is laid off after taking the loan? For many plans, separation from employment results in the need to repay any outstanding loans. Plan sponsors should consider changing their loan policy to allow for continuation of loan repayment after separation of employment. They may also want to explore other options to build a “safety net” for their most financially at-risk employees and participants to protect them from loan defaults following layoffs, such as including automated loan insurance in a loan program. These options may be available from recordkeepers already.

- What if the participant has already been laid off? Many plans don’t allow participants who are no longer employees to originate loans—if plan sponsors intend the new coronavirus loans to be available to workers who have already been laid off, they need to take this into account in designing the new loan program and to discuss whether this is possible with their recordkeepers.

- Can the participant “roll-in” a CRD? Not all plans allows participants to “roll-in” money from another plan or individual retirement account (IRA)—if a plan adopts CRDs but doesn’t allow participants to return money taken as a distribution, it makes it less likely any unused money will be preserved for retirement.

- Talk to your recordkeeper right away! What plan sponsors are legally allowed to do under these new provisions, what they decide they want to do, and what their recordkeepers can do may not be the same. Sponsors should talk to their recordkeeper right away about its processes for adopting these provisions and ensure they understand how that process will work for their plan. Some recordkeepers may already have sent a notice that they will apply some or all of these provisions to plans unless employers object—what’s known as a negative consent process. Others require affirmative consent from their clients before they will proceed. In either case, plan sponsors need to make timely, considered decisions about these provisions.

Whatever sponsors decide after taking into account the short- and long-term effects on the plan and its participants, be aware that it will be necessary to amend plan documents. Fortunately, the CARES Act permits retroactive plan amendments until 2022—this provides needed flexibility to immediately make and adjust arrangements with service providers and participants to resolve issues before finalizing any plan amendments. It should be noted that this retroactive amendment provision does not apply to non-CARES Act plan changes sponsors may be considering. Eliminating matching contributions or other reductions in benefits likely requires prospective plan amendments and advance notice to participants.

The pandemic is an unprecedented crisis, and participants in financial distress may have no choice but to reluctantly “break the glass” with a 401(k) loan or distribution to cover financial emergencies. That said, as the old adage goes, “this too shall pass,” and as plan sponsors make these decisions—and as plan fiduciaries implement them—it’s critical to take effective steps to balance current needs while preserving long-term retirement benefits.

Bradford Campbell is the former assistant secretary of labor for employee benefits and former head of the Employee Benefits Security Administration and is currently a partner at Faegre Drinker Biddle & Reath LLP. He is a member of Custodia Financial’s Strategic Advisory Council (SAC) and serves as paid outside legal counsel to Custodia Financial. Nothing in this article should be considered as financial or legal advice. Plan sponsors should consult their own financial and legal advisers for guidance.

This feature is to provide general information only, does not constitute legal or tax advice, and cannot be used or substituted for legal or tax advice. Any opinions of the author do not necessarily reflect the stance of Institutional Shareholder Services or its affiliates.