Never miss a story — sign up for PLANSPONSOR newsletters to keep up on the latest retirement plan benefits news.

Pandemic Highlights Reasons for Reviewing Plan Fees

Michael Bird, with Valentine 401(k), discusses how plan sponsors can evaluate 401(k) fees as a way to save money and a way to boost participant retirement savings.

Pandemic. Postulation. Panic. The events of the past few months have had a dramatic impact on nearly every business. Whether you are closed, working from home or implementing policies to keep your customers and employees safe, plan sponsors understand that things are different for now.

There is a saying, “Spending is flexible on the upside, but rigid on the downside.” It is a quip that gets at the culture of increasing spending as income increases, but not appropriately cutting back on expenses when income decreases or becomes less stable. Now, more than ever, is a time to review expenses and cut back where possible. For some, the atypical circumstances of having lower sales and more free time make bargain hunting a more profitable venture than it otherwise would be.

One possible area to explore cost savings is in your 401(k) or other related retirement savings plan. Plan sponsors might start here for a variety of reasons.

Unclear Fees

401(k) plan fees are notoriously confusing. There are charges from the recordkeeper, from the third-party administrator (TPA), from the investment adviser and from the custodian. Fees charged to the participant, to the employer and through the investment options. Fees for Form 5500 filings and for 3(16), 3(21) or 3(38) services. Flat fees, per-participant fees, asset-based fees and 12b-1 fees. Are you lost yet? It is this type of confusion that has many plans unknowingly overpaying for plan services.

Liability

As a plan sponsor, you have the responsibility to monitor plan fees to verify that they are “reasonable.” While this does not strictly require you to work with the lowest cost vendors, it does put pressure on you to have a good reason for using higher cost alternatives. Over the past few years, litigation surrounding 401(k) plan fees has significantly increased. It is reasonable to believe that this liability is exacerbated by the recent market volatility and overall panic and fear that many participants are feeling. To meet your responsibility as a plan sponsor, you should be evaluating your plan expenses and comparing them to competitive rates at least every three years. Can you say you have done that?

Compounding

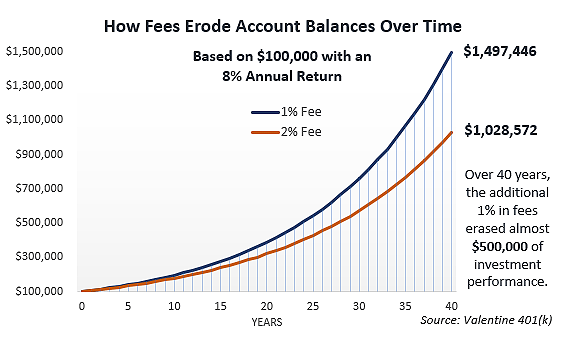

Many of us have heard of compounding as a reason to save more for retirement or to begin saving early—and there is merit to those arguments. However, you can significantly reduce the beneficial effects of compounding by having excessive fees. Look at the example below. Over 40 years, a fee increase of just 1% eroded almost half a million dollars of investment gains.

Over time, a small difference in plan fees can make a large difference in retirement accounts.

How to Get a Clear Cost Comparison

It is critical to regularly evaluate your plan expenses and compare them to benchmarks and competitive rates. And it is fairly easy to find vendors that will do the legwork for you by providing you a free cost comparison. However, it can be difficult to compare fees from various providers if the fee structure is different. That is why you should always ask for the comparison to be shown in total real dollars and as a percentage of plan assets. Once you are comparing apples to apples, you can break it down into participant cost versus employer cost. As always, be sure to document your review process and your reasoning for selecting the service provider that will be serving your plan.