Never miss a story — sign up for PLANSPONSOR newsletters to keep up on the latest retirement plan benefits news.

Accepting Responsibility

Plan sponsors this year show increased awareness of and attention to the makeup and monitoring of their target-date funds, yet they are less concerned about the potential risks.

The eighth annual defined contribution (DC) investment study by Janus Capital Group and PLANSPONSOR, conducted in conjunction with PLANSPONSOR’s 2014 DC Survey, focused again on the selection and ongoing monitoring of qualified default investment alternatives (QDIAs) as well as single-, multi-manager and custom target-date funds (TDFs). The results of the study affirmed some trends that have been evident for a few years, yet some of the study’s findings were still surprising.

Monitoring the Situation

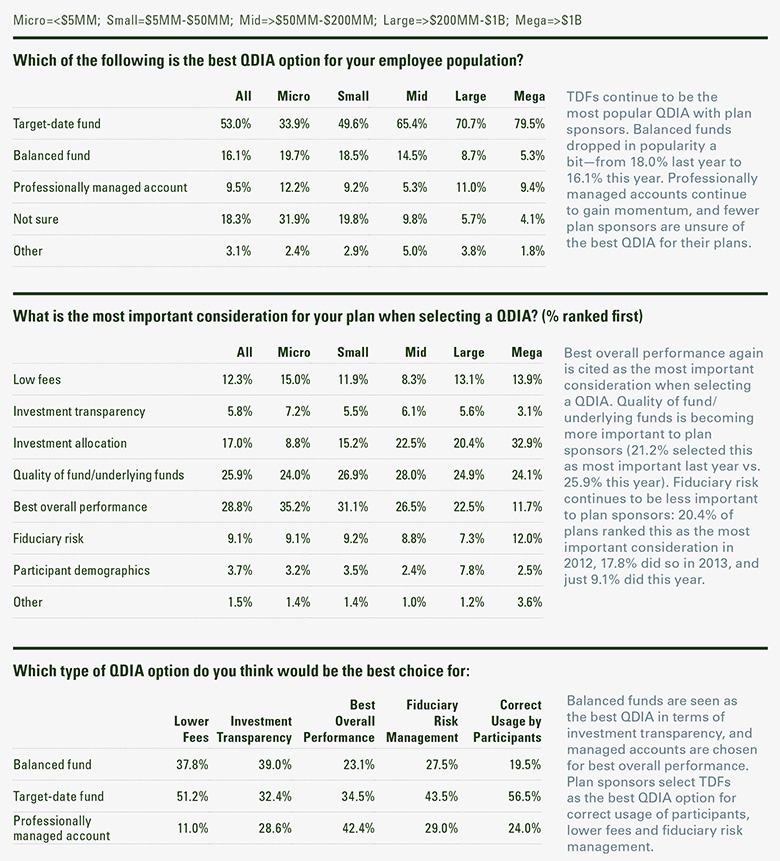

Continuing a multi-year upward trend, now more than half (53%) of plan sponsors believe that TDFs are the best QDIA for their employees. When it comes to selecting the QDIA for their plans, 29% of sponsors look at overall fund performance as the most important consideration, although the largest plans place higher importance on investment allocation and the quality of the underlying funds within the QDIA. Fiduciary risk, once one of the most important considerations of plan sponsors when selecting their QDIAs, is now the top consideration for just 9% of plans.

When compared to other commonly-used QDIA vehicles, plan sponsors cite TDFs as the best QDIA option in terms of lower fees, fiduciary risk, and correct use by participants. On the other hand, balanced funds are seen as more transparent than TDFs, and managed accounts as having the best overall investment performance.

Of the plans that have an investment policy statement (IPS), more than half (51%) report that the IPS specifically covers the underlying funds within their TDFs. This is a sharp increase from last year, when just 37% of plans indicated that the IPS covered the underlying TDF funds. In addition, fewer plan sponsors this year—particularly larger plans—are unsure whether their IPS covers the underlying TDF investments.

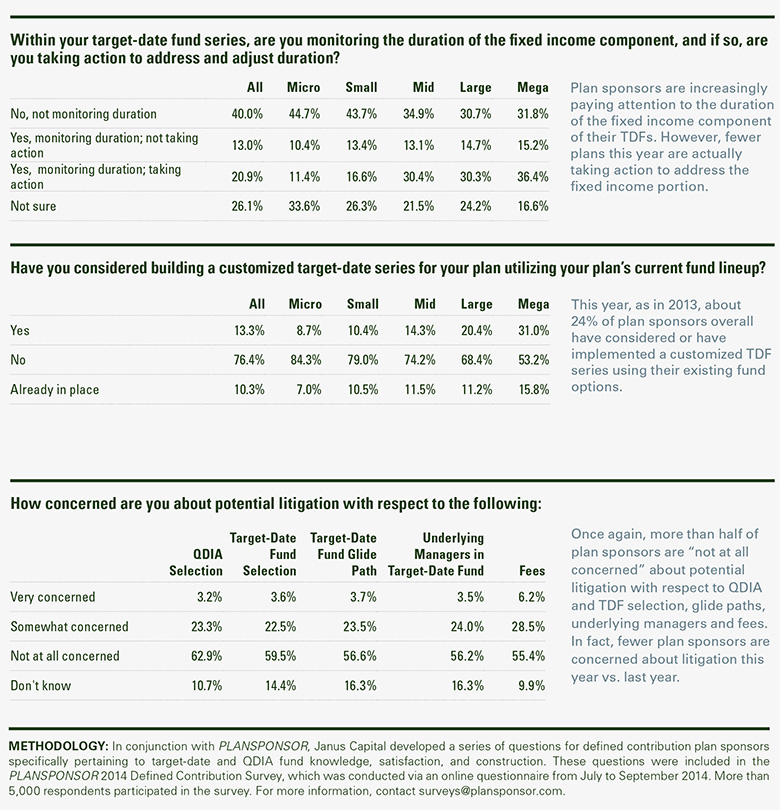

More than eight in 10 plans now believe that they themselves have a fiduciary responsibility to evaluate the underlying investments in their TDFs, up 6% from 2013. Along that vein, more than one-third of plan sponsors indicate that they monitor specifically the duration of the fixed income component of their TDFs, which is up significantly from the 19% that claimed to do so last year. “Although no one knows when rates will ratchet up and at what pace, it’s widely accepted they will in fact increase. With that backdrop in mind, we were perplexed with last year’s numbers regarding the lack of TDF duration monitoring. Seeing this number gap close year-over-year is heartening,” notes Russ Shipman, managing director and senior vice president of Janus’ Retirement Strategy Group.

Custom Built

About 26% of plan sponsors overall—and nearly half of the largest plans—have implemented or are considering implementing a custom target-date series for their plan. It may be no coincidence that the survey found plan sponsors to be increasingly aware of the February 2013 Department of Labor (DoL) bulletin providing guidance on selecting and monitoring TDFs (just 26% this year indicated not being familiar with the bulletin). The bulletin included the suggestion for plan sponsors to inquire with their managers and consultants about the suitability of custom and non-proprietary target-date fund options. With almost two thirds of plan sponsors not confident that their single-manager TDF is “best-in-class,” perhaps some are seeking out assistance with new options.

“More than eight in 10 plans now believe that they themselves have a fiduciary responsibility to evaluate the underlying investments in their TDFs, up 6% from 2013.”

Risk Business

As target-date funds continue to be viewed as the best QDIA choice in terms of fiduciary risk management, plan sponsors are becoming less concerned about litigation with each passing year. Relatively few plans (<7%) now say they are “very concerned” about potential litigation when it comes to QDIAs or TDFs. Along the same lines, more than 55% of plans are now “not at all concerned” about litigation with respect to QDIA or TDF selection, TDF glide paths, underlying TDF managers, or even fees. However, just 37% of plan sponsors that have single-manager TDFs believe their manager is “best in class” for all the underlying funds it is managing, and more than half of micro and small plans say they are “not sure” when their TDF glide paths reach their final allocations. So while they may be confident about the use of TDFs and are more closely monitoring them, plan fiduciaries need to make sure they are educating themselves sufficiently as well as taking action when needed with TDF construction and manager due diligence.