Never miss a story — sign up for PLANSPONSOR newsletters to keep up on the latest retirement plan benefits news.

Keeping an Eye on Them

New strategies to improve retirement readiness often fall short of addressing the needs of one important audience: key employees. These higher-income earners face a number of barriers to tax-efficient retirement savings, including the impact of recent personal income tax increases.

Nonqualified deferred compensation (NQDC) plans provide a way for those higher-income employees to save more effectively toward their goals. NQDC plans also help employers attract, retain and reward top talent. Alison Cooke-Mintzer, editor-in-chief of PLANSPONSOR, spoke with Gary Dorton, vice president of Nonqualified Employer Solutions at the Principal Financial Group, about how NQDC plans can help effectively address retirement readiness for an organization’s key employees.

PS: The retirement industry is putting a heavy focus on the issue of retirement readiness for all employees. Why is the approach to retirement readiness different for key employees?

Dorton: The focus on retirement readiness tends to revolve around qualified defined contribution (DC) plans such as 401(k)s. More plan sponsors are incorporating features such as automatic enrollment at higher default rates and automatic escalation to help improve retirement outcomes. And in a recent survey conducted by Brightwork Partners for The Principal Knowledge Center, two-thirds of plan sponsors said they measure the success of their 401(k) plan by the extent to which it gets participants on track to a more successful retirement.

That approach is good for the general employee base. But it doesn’t fully address the retirement needs of those with higher incomes. The limitations in qualified DC plans—both annual limits and those due to ADP/ACP testing—significantly reduce the opportunities for key employees to save on a pre-tax basis. As a result, retirement replacement ratios for these employees tend to be lower. Nonqualified deferred compensation (NQDC) plans can help bridge the retirement readiness gap for higher-income employees.

PS: How do key employees view their retirement readiness?

Dorton: Our surveys of key employees over the years have found that those who are participating in NQDC plans tend to have more confidence about their retirement readiness and are more likely to take positive actions than those not participating. In our 2013 survey, nearly 90% of NQDC plan participants reported some level of confidence in their retirement readiness. But among key execs who are not participating in an NQDC, only about 76% are confident in their retirement readiness.

We’re seeing an increase in the number of key employees who have written financial plans that include goals and sources of retirement income. In 2013, half of participants had a written plan, compared with only 41% with a plan in 2012. Employer-sponsored retirement benefits targeted for key employees can positively affect behaviors and attitudes around retirement preparation.

PS: Tax legislation over the past several years has been directed more toward highly compensated employees. How have the changes affected retirement preparedness for this key employee demographic?

Dorton: Many key employees felt the impact of the American Taxpayer Relief Act in their paycheck and during this year’s tax filing season. The act generated a new set of taxation issues on both ordinary and investment income for high-income individuals. In addition, the Patient Protection and Affordable Care Act [ACA] also resulted in higher taxes for some higher-income earners. These changes make retirement planning more challenging for key employees and increase the need for tax-deferred savings vehicles.

PS: How do NQDC plans help with tax issues?

Dorton: NQDC plans offer one of the best options to key employees for pre-tax deferral and tax-deferred growth to help meet their needs for retirement. This can provide the potential for higher long-term returns compared with after-tax investing and enable key employees to be on track for retirement.

Key employees can use NQDC plans to better manage their current tax thresholds. For example, participants can defer enough current income to reduce or eliminate higher tax rates below the thresholds in the revised tax laws.

PS: How do these plans benefit key employees and employers?

Dorton: As key employees reach the maximum savings limits of qualified DC plans, NQDC plans help meet the need for additional tax-deferred savings. Key employees value NQDC plans—nine out of 10 surveyed said they recognize the importance of NQDC plans in helping them reach their retirement goals. And a majority confirmed that deferred compensation plans are also important in deciding to take a new job and deciding to stay with a current employer.

The employer benefits because NQDC plans are an important tool to help recruit, retain and reward top talent. That’s why we see NQDC plans increasingly included as part of a competitive benefits package.

PS: What evidence is there that says NQDC plans are an important part of key employees’ retirement readiness?

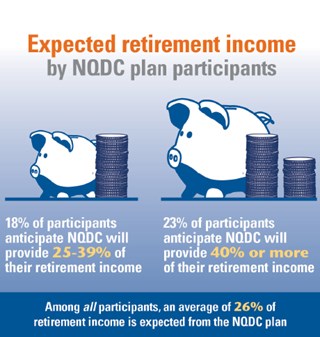

Dorton: Our most recent survey shows that key employees are depending on NQDC to play a significant role in their retirement readiness. When we asked participants what percentage of their retirement income the NQDC plan would provide, the average target among all respondents was 26%. About one in four participants believes the deferred compensation plan will provide as much as 40% of income in retirement.

PS: What are some key considerations for plan sponsors to examine if they want to address this issue of key employee retirement readiness?

Dorton: Changing qualified plan designs to help improve participant outcomes is critical for employees in general but may not do enough to address retirement readiness needs of key employees. The features that help many employees—automatic enrollment, automatic escalation—are not going to have the same impact on key employees because they already participate and save to the max. NQDC plans give key employees the opportunity to save higher amounts for retirement on a tax-deferred basis.

Here are some other important steps to consider:

- Encourage additional retirement savings by offering an employer match in the NQDC plan that makes up for any missed match in the qualified plan. Also, consider a match above and beyond that to help increase participation;

- Provide easy access to plan information so participants can better understand and keep track of their plan;

- Ensure that the number and type of investment choices available in the plan have been reviewed and meet participant expectations;

- Offer education and assistance, to make it easier for participants to make decisions and take action; and

- Focus on communication about the role of the plan and the timing of key decisions. That increases participants’ satisfaction—not only in the plan but with their employer.

We also believe it is important for participants to work with financial professionals to establish a retirement savings target. Having a specific savings goal to achieve within a set time frame helps participants more effectively utilize their deferred compensation plan.