For more stories like this, sign up for the PLANSPONSOR NEWSDash daily newsletter.

Target-Date Fund Management

Target-date funds (TDFs) are unlike any other class of investments. Not only do they include multiple asset classes within their overall portfolio, but they also have different risk-return trade-offs for the portfolios at various points along the glide path, or time horizon, of the investment. Throughout both bull and bear markets, they must achieve some definition of success by providing their investors with the best return possible, given the unique risks inherent in these strategies. Rich Weiss, Senior V.P. and Senior Portfolio Manager for asset allocation at American Century Investments, including the One ChoiceSM Target Date Portfolios, recently spoke with Alison Cooke Mintzer, editor-in-chief of PLANSPONSOR, about the firm’s approach to target-date fund management.

PS: As the One Choice Target Date Portfolios celebrate their 10th anniversary, what has the last decade taught you about target-date fund investing?

Weiss: At a high level, this past decade of managing target-date portfolios has shown us that helping investors build wealth for retirement is more like a marathon, not a sprint. That is, it’s not about winning the last leg or the downhill slope—which would be analogous to the bull market—it’s about outperforming over the long haul through both bull and bear markets.

Target-date fund investing strategies are designed to go the distance—spanning years if not decades. Unlike with single asset class investments, balanced funds or even target-risk funds, this element of time adds a level of complexity to portfolio management as you move through the wealth accumulation and then decumulation phases.

To continue the marathon analogy, our objective with the One Choice Portfolios is not to win with the fastest time, or give one participant the highest possible account balance, as some of our competitors have as a statistical objective. When you offer a target-date series to hundreds of thousands of participants across all different demographics, it’s about having the greatest number of them actually cross the finish line, successfully reaching fully funded retirements, even though the average balance may be lower than the winner’s. To do that, you can’t have this very rapid-pace, just-look-good-in–a-bull-market scenario. It has to be a steady, consistent pace that the most investors can tolerate. That’s our approach. We seek to provide a target-date series that has a much steadier, more consistent, lower-volatility return across time and across participants so that most of them can “win.” The fact that American Century Investments’ One Choice Portfolios just reached their 10th anniversary puts us in fairly rarified air. There are not many providers with this breadth of track record. It spans a full economic cycle, including both the 2008 debacle and then the just-as-unprecedented bull market.

PS: How are One Choice Portfolios managed to encourage participants to remain invested throughout the bull and bear markets they’ll see over their lifetimes?

Weiss: Target-date strategies present a bevy of risks not associated with other investment strategies, including longevity, abandonment and sequence-of-returns risks. It’s a balancing act: weighing all these different risks throughout a lifetime, trying not to give too much credence to one, because in weighing one more heavily, you might overexpose your investors to another.

For instance, we use sophisticated computer techniques to assess the probability of participants not outliving their money, which is the essence of longevity risk, and aim for a higher probability of a participant not running out of money.

On the one hand, getting the most return in the wealth accumulation phase seems easy—you load up on risky assets—but with that comes a much a wider dispersion, or volatility, of return and ultimately wealth outcomes. That’s why we weigh the distribution—or dispersion—of that return as heavily as the level of the ending return.

We do this because, if participants are nearing or reaching retirement and there’s a severe market shock, á la 2008, the statistics have shown that many will abandon the strategy—at precisely the wrong time. It has been shown academically, and also in the real world, that as investors accumulate wealth, they become more risk averse and generally sell or abandon their strategies when the going gets rough when it has to last throughout retirement. Participants’ peak wealth is generally at the retirement date, and that’s when abandonment risk peaks. So we also measure tail risk, the probability that an investment will experience unusually large swings in returns, and we structure the portfolios to minimize these swings.

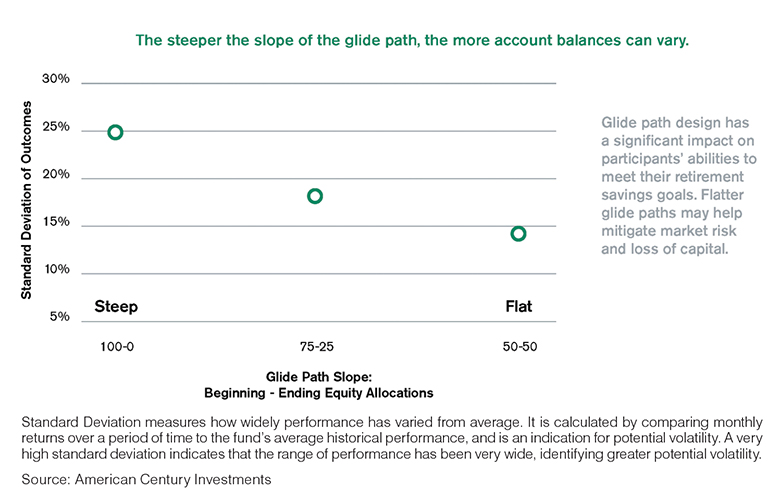

Another major risk that is less talked about is “sequence-of-returns” risk, also known as “path dependency.” Most investors naively assume that the average return, and volatility of that return over time, is all that matters for building wealth. This is not the case. The exact sequence of returns a participant experiences matters significantly. It can alter ending wealth tenfold just because of the good luck or bad luck a participant personally experiences in the markets in his or her investing career. A bear market early on in one’s career will have significantly less impact on ending wealth than the same bear market, experienced just before your retirement date. There are different metrics to measure the degree of path dependency you have—how much potential for dispersion of returns exists over various time periods. The main method for minimizing this particular risk is to dampen the slope of the glide path. Less abrupt changes in asset allocation over time helps to immunize a portfolio from sequence-of-returns risk, at the margin.

The common denominator in all these discussions about risk in TDFs is that the risk allocation is inversely related to wealth accumulation, not just age. Many young people are very risk averse, and many are risk seeking, so simply matching risk posture or glide path to age is an antiquated concept. Wealth level determines risk tolerance and should be the major determinate of asset allocation or glide path.

PS: Is there a secret to target-date design when managing all the risks for a large or particularly diverse plan participant population?

Weiss: We believe the secret lies in optimizing the probability of a successful retirement for the broadest number of participants. You can do that in the design and construction of the glide path and the de-risking process over time. One Choice Portfolios feature a distinctly flatter glide path than most—there are no severe drops in equity exposure, year to year—as well as broad diversification among various asset classes, to create a smoother ride for participants.

Also, there’s the so-called landing point at retirement. One Choice Portfolios land at 45% in equities at the retirement date; that’s a good example of how we optimize the probability of success for the most participants. The optimal equity allocation, or risk level, at retirement varies by investor, depending on, most importantly, how well each has saved over his working life. It also depends on how long he lives in retirement—effectively, his investment horizon—and what the market does in his retirement years.

These variables are all essentially uncontrollable, or unknowable, but when you offer a target-date fund, you can’t say, “It depends.” You have to pick a spot to land for your investors, and that spot must be an effective compromise for the broadest range of participants. Our landing point of 45% in equities at retirement date is just that. It’s a healthy level of risky assets, which provides participants who have not saved well their best chance at retirement success. Yet, 45% in risky assets is not so risky that it severely penalizes the good savers, who do not require much in the way of risk assets to retire successfully.

PS: Faced with so many potential investments, how do you determine what warrants a place in your portfolio?

Weiss: It’s critical to have a well-defined process for asset-class evaluation and not just follow the latest fads. The winner in target-dates isn’t the one with the most asset classes. You must consider their correlation structure, the allocation you’ll give to them, the asset-class volatility and other metrics. As new asset classes evolve and become more liquid, more accessible, it’s imperative to consider them as potential diversifiers, a diversifier being an investment that may reduce risk to increase the potential return over various market cycles. Over the last few years, we have witnessed a virtual arms’ race to add the latest trendy asset classes; commodity exposure is an example. Fortunately, the One Choice Portfolios have, since inception, been broadly and effectively diversified, including extended asset classes and many of the alternatives popular today: real estate investment trusts (REITs), high-yield bonds, Treasury inflation protected securities (TIPS), emerging markets equity, and alternatives, such as 130/30 strategies.

PS: Some say target-date funds are more alike than different. How do you distinguish the One Choice Portfolios from the others?

Weiss: From a distance, it may appear that we’re all alike. Again, there are three key differentiators: glide path, diversification and underlying management, upon which target-date strategies are built. Since inception, our approach has focused on minimizing volatility and increasing or maximizing the consistency of returns through time and across participants for our strategies. If you can generate a competitive return and do so at a steadier rate or with a lower volatility, you will at the end of the day accumulate more wealth. n

You should consider the fund’s investment objectives, risks, charges and expenses carefully before you invest. The fund’s prospectus or summary prospectus, which can be obtained by visiting americancentury.com, contains this and other information about the fund, and should be read carefully before investing.

A target-date portfolio’s target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date.

Each target-date portfolio seeks the highest total return consistent with its asset mix. Over time, the asset mix and weightings are adjusted to be more conservative. In general, as the target year approaches, the portfolio’s allocation becomes more conservative by decreasing the allocation to stocks and increasing the allocation to bonds and money market instruments.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

American Century Investment Services, Inc., Distributor

© 2014 American Century Propriety Holdings, Inc. All rights reserved.